FLAT STOCK MARKET

It’s not what you look at that matters, it’s what you see. -Henry David Thoreau

“In moving to the woods, Henry David Thoreau sought to discover the true necessities of life and built a cabin, for the cost of $28. 12 near Walden Pond, where he lived for two years, beginning in the summer of 1845. Thoreau explains that most people become trapped in their lives. He went to the woods to prove that one could break free of the slavery and take care of his own needs.’

Retreating to a cabin by the lake allowed Thoreau to retrench and think in a more expansive fashion. This week ‘the market’ achieved new highs. Would Thoreau take that at face value? Is that true? When commentators reference ‘the market’ it sounds like all stocks are doing great.

If we take a closer look would we reach the same conclusion?

You have to understand that there is more than one market and you have to review all of them daily. The bond aggregate index also hit a new high and recently gold has been hitting new five year highs on a daily basis (you haven’t been hearing about that have you?). This is a contradiction. The strength in gold and bonds is a flight to safety, indicating lower economic growth expectations and concerns over excessive stock market valuations. (source: Bloomberg, Bloomberg Barclays US Aggregate Bond Index).

The press does investors a disservice in two ways – First, understand that the big move last week was due to the algo’s (algorithmic traders = computer trading = artificial intelligence) buying the Dow and S&P indices after Trump Tweeted that he was meeting China’s Premier Xi at the G20 meeting this weekend. The computers believe that Trump and Xi will strike a deal at the meeting. Second, the press predominantly quotes the Dow Jones Industrial Index which has drawbacks: a) it isn’t global, b) it only represents 30 companies, and c) it is price weighted and subject to distortions when a handful of companies with big stock prices have a good day.

Let’s break this down visually.

Dow Jones Industrial Average: The Dow is back to new highs, a level that has failed three times previously. The blue line across the top of this chart is referred to as ‘resistance’, a point where sellers overcome buyers (valuation reasons would be a reason). The real story is if the Dow can break resistance. So far it has failed. If it fails here it could be a big negative.

Note: If price breaks resistance we could have a europhoric breakout, which we would want to own using trailing stop loss orders to protect our principal.

Looking at broader indices that are not subject to the undue price influences of a handful of super-cap companies with a high stock price, we see things from a different perspective.

The Value Line Geometric Index is one of the broadest indexes, including mid and small cap companies; it is a ‘total market’ index. The Value Line Geometric Index is clearly in a bear market.

Most investors are diversified globally. The Dow Jones Global Index is not at a new high, having just gotten back to where it was 18 months ago.

Mid cap stocks are still in a bear trend (S&P 400 Mid Cap Index).

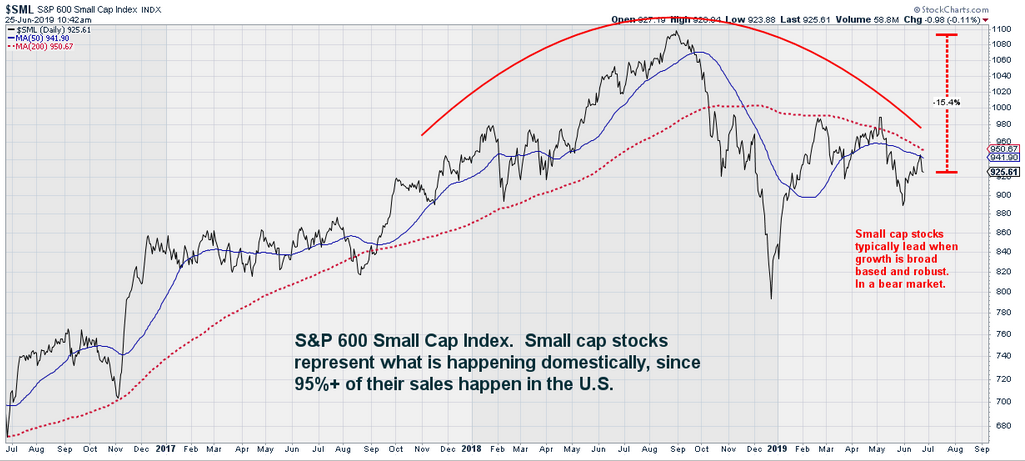

Small Cap stocks are in a bear trend (S&P 600 Small Cap Index).

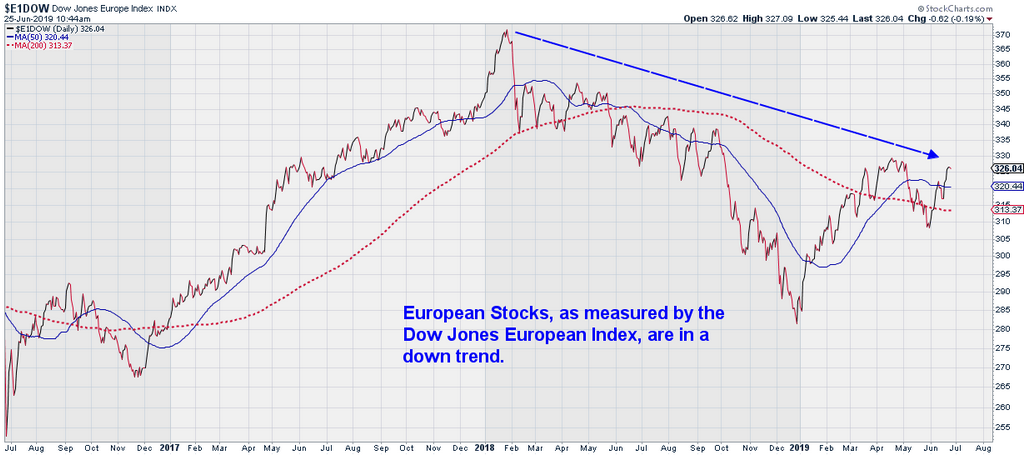

Europe is in a downtrend.

Asia is in a downtrend.

So the market hit new highs? It’s not what you look at that matters, it’s what you see. – Henry David Thoreau

1-871498

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. This memorandum is being made available for educational purposes only and should not be used for any other purpose.

The information contained herein does not constitute and should not be construed as representation or solicitation for the purchase or sale of any security or related financial instruments in any jurisdiction. The investments discussed or recommended in this report may not be suitable for all investors. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing.

Investing involves risks including possible loss of principal. Past performance does not guarantee future results. Any investment or investment strategy outlined herein are not suitable for all investors, readers should conduct their own review and exercise judgment prior to investing. Wherever there is the potential for profit there is also the possibility of loss. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

This report expresses the opinions and views of the author as of the date indicated and are based on the author's interpretation of the concepts therein, and may be subject to change without notice. Neither Highcroft, Inc., Gerald Asplund, nor LPL Financial, LLC has no duty or obligation to update the information contained herein.

To the extent you are receiving investment advice from a separately registered independent investment advisor or broker, please note that Highcroft, Inc., Gerald Asplund, and LPL Financial LLC are not an affiliate of and makes no representation with respect to such entity.

Certain information contained herein concerning economic trends, Fundamentals, and/or Technical analysis, and performance is based on or derived from information provided by independent third-party sources.

The economic forecasts set forth in this material may not develop as predicted.

Technical analysis is generally based on the study of price movement, volume, sentiment, and trading flows in an attempt to identify and project price trends. Technical analysis does not consider the fundamentals of the underlying corporate issuer.

The sources from which information has been obtained is assumed to be reliable; the accuracy of such information is not guaranteed and the accuracy and completeness of such information has not been independently verified.

From time to time the publisher, his associates or members of his family may have a position in the securities mentioned in this report: This report, including the information contained herein, has been prepared exclusively for the use of Highcroft, Inc. clients, and may not be copied, reproduced, redistributed, republished, or posted in whole or in part, in any form without the prior written consent of Highcroft, Inc.

The modern design of the S&P 500 stock index was first launched in 1957. Performance back to 1950 incorporates the performance of predecessor index, the S&P 90.

All indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. All performance referenced is historical and is no guarantee of future results.

The investment products sold through LPL Financial are not insured deposits and are not FDIC/NCUA insured. These products are not Bank/Credit Union obligations and are not endorsed, recommended or guaranteed by any Bank/Credit Union or any government agency. The value of the investment may fluctuate, the return on the investment is not guaranteed, and loss of principal is possible.

ABOUT US

Highcroft Investment Advisors provides retirement planning, investment management, financial planning, fiduciary investment management, and lifetime income planning. Certified Financial Planner. Working with business owners, individuals, and wealthy families near Wayzata, Minnetonka, Plymouth, Orono, Minnetrista, and Minneapolis Minnesota (55402, 55391, 55447, 55364, 55428).

Highcroft Investment Advisors serves as a 3(21) and 3(38) Investment Advisor and fiduciary for labor union supplemental 401(k) and pension plans and corporate 401(k) plans. Highcroft works with the union's counsel, recordkeeper, administrator, and the plan's trustees. United Association, Plumbers, Pipefitters, Steamfitters, IBEW, and Carpenters. Serving Wisconsin and Minnesota. 401(k) investment management provided through LPL Financial's corporate RIA - offering 3(21) and 3(38) services.

Working with business owners, individuals, and wealthy families near Wayzata, Minnetonka, Plymouth, Orono, Minnetrista, and Minneapolis Minnesota (55402, 55391, 55447, 55364, 55428). As independent financial advisors we are not driven by certain products or services, instead we focus on your needs as an individual. Services include fiduciary fee only, retirement and divorce financial planning, life insurance, capital preservation, lifetime income planning, bonds, stocks, ETF, income, IRA, brokerage, rollover IRAs. Financial advisor near me, financial planner near me, independent planner near me.