HIGHCROFT WEALTH SHIELD PROTECTS ACCOUNT VALUES

Investors will note that we have started to shift monies back into stocks, on a diversified global basis.

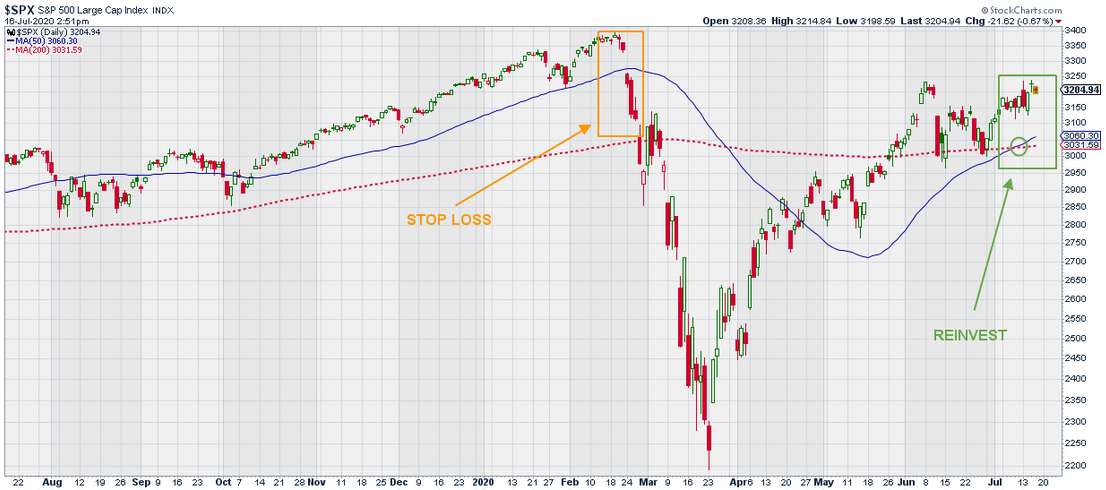

Our rules based, risk management process (which uses stop losses) avoided the large drawdown in the markets earlier this year. The following charts illustrate the point.

This chart of the Dow Jones Global Index, which is representative of a globally diversified equity portfolio, is annotated to show the basic period in which we divested of stocks and the period where we are now averaging back in.

In my opinion this process is conservative in nature. We re-enter as trend resumes and exit when trend breaks down. My clients who depend upon their retirement accounts for their retirement income appreciate the low volatility [chart courtesy of stockcharts.com]

The same story exists for U.S. stocks, using the S&P 500 as a proxy. Here we see the same stop loss process in action. [chart courtesy of stockcharts.com]

I know what you’re thinking, because I was thinking the same thing. What about the correction. Over the past three months we have retained and back tested services that will allow us to take advantage of that volatility. To date we have committed to investors that we would help them with preservation of principal and growth of capital. We feel that going forward we can still meet that commitment, with the addition of some trading strategies that will allow for a quicker re-entry. I will provide further detail on that next week.

LPL 1-05033971

DEFINITIONS

Dow Jones Global Index – a 150 stock index of leading companies from around the world in all industries. It covers both developed and emerging markets. The components are equally weighted, which means that price movements of the larger stocks have no greater impact on index performance than the price movements of the smaller stocks.

S&P 500: The modern design of the S&P 500 stock index was first launched in 1957. Performance back to 1950 incorporates the performance of predecessor index, the S&P 90.

The index is a capitalization weighted index of the 500 large companies listed on various stock exchanges (such as the NYSE or NASDAQ). The S&P 500 was developed and continues to be maintained by S&P Dow Jones Indices, a joint venture majority-owned by S&P Global. The S&P 500 differs from the Dow Jones Industrial Average and the NASDAQ Composite index, because of its diverse constituency and weighting methodology. It is one of the most commonly followed equity indices, and many consider it one of the best representations of the U.S. stock market.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. This memorandum is being made available for educational purposes only and should not be used for any other purpose.

The information contained herein does not constitute and should not be construed as representation or solicitation for the purchase or sale of any security or related financial instruments in any jurisdiction. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing.

Investing involves risks including possible loss of principal. Past performance does not guarantee future results. Any investment or investment strategy outlined herein are not suitable for all investors, readers should conduct their own review and exercise judgment prior to investing. Wherever there is the potential for profit there is also the possibility of loss. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors.

This report expresses the opinions and views of the author as of the date indicated and are based on the author's interpretation of the concepts therein, and may be subject to change without notice. Neither Highcroft, Inc., Gerald Asplund, nor LPL Financial, has no duty or obligation to update the information contained herein.

To the extent you are receiving investment advice from a separately registered independent investment advisor or broker, please note that Highcroft, Inc., Gerald Asplund, and LPL Financial are not an affiliate of and makes no representation with respect to such entity.

Certain information contained herein concerning economic trends, Fundamentals, and/or Technical analysis, and performance is based on or derived from information provided by independent third-party sources. The economic forecasts set forth in this material may not develop as predicted.

Technical analysis is generally based on the study of price movement, volume, sentiment, and trading flows in an attempt to identify and project price trends. Technical analysis does not consider the fundamentals of the underlying corporate issuer.

The sources from which information has been obtained is assumed to be reliable; the accuracy of such information is not guaranteed and the accuracy and completeness of such information has not been independently verified.

All indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. All performance referenced is historical and is no guarantee of future results. Investing in the index would require investors purchase an investment product, which would involve fees and expenses.

ABOUT US

Highcroft Investment Advisors provides retirement planning, investment management, financial planning, fiduciary investment management, and lifetime income planning. Certified Financial Planner. Working with business owners, individuals, and wealthy families near Wayzata, Minnetonka, Plymouth, Orono, Minnetrista, and Minneapolis Minnesota (55402, 55391, 55447, 55364, 55428).

Highcroft Investment Advisors serves as a 3(21) and 3(38) Investment Advisor and fiduciary for labor union supplemental 401(k) and pension plans and corporate 401(k) plans. Highcroft works with the union's counsel, recordkeeper, administrator, and the plan's trustees. United Association, Plumbers, Pipefitters, Steamfitters, IBEW, and Carpenters. Serving Wisconsin and Minnesota. 401(k) investment management provided through LPL Financial's corporate RIA - offering 3(21) and 3(38) services.

Working with business owners, individuals, and wealthy families near Wayzata, Minnetonka, Plymouth, Orono, Minnetrista, and Minneapolis Minnesota (55402, 55391, 55447, 55364, 55428). As independent financial advisors we are not driven by certain products or services, instead we focus on your needs as an individual. Services include fiduciary fee only, retirement and divorce financial planning, life insurance, capital preservation, lifetime income planning, bonds, stocks, ETF, income, IRA, brokerage, rollover IRAs. Financial advisor near me, financial planner near me, independent planner near me.