TECHNOLOGY UPDATE

The NASDAQ Index, and technology stocks broadly, have been stuck in a bear trend (current price is below the trend and continues to make lower highs and lower lows).

This is notable since the mega tech stocks are considered the market leadership over the past 10 years. Every bull market has what investors refer to as ‘the generals’, those stocks that get bid up to high valuations and large market caps. They have an out-sized contribution to overall market returns. When they roll over they in turn have the opposite effect.

Thoughts:

A) When 1 week of losses leads to 1 month of losses and then 1 quarter of losses you have a trend.

B) Technology is on our watch list, if the intermediate term bear trend stabilizes and reverses there could be some good investment opportunities (this could be a long term consolidation and not a long term bear market in tech).

C) Current valuations in the technology sector are at multi-decade highs, the last time this occurred was in 1999 and the NASDAQ fell -75% over the next 3 years as the tech bubble slowly deflated (taking with it a lot of retirement portfolios).

D) Technology is roughly 27% of the S&P 500 index and depending upon where investors are positioned a substantial bear market in tech stocks could be negatively material.

E) Our investors are currently avoiding technology for now and are instead positioned in U.S. Financials and Banks, U.S. Industrials, emerging markets, foreign developed markets, and commodities to take advantage of the inflationary effects of what could be $6 Trillion in spending by the government.

Apple Computer – Apple Computer is one of the largest technology stocks.

NASDAQ Index

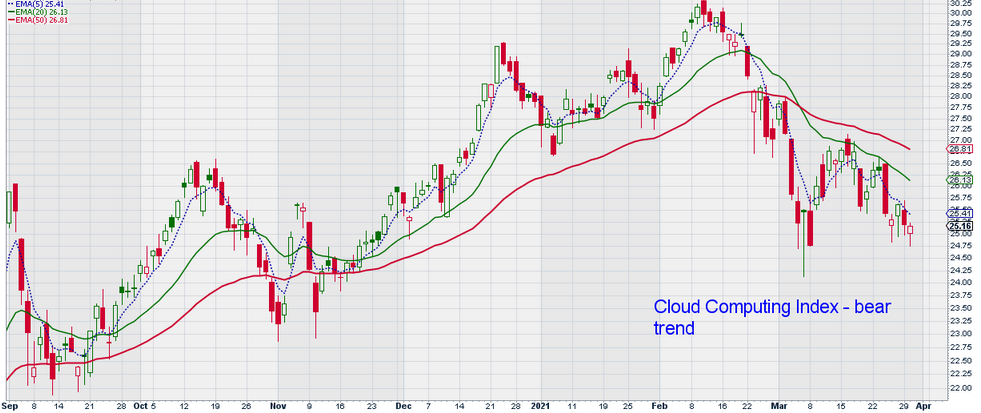

Cloud Computing Index

Social Media Index

China Technology Index

LPL 1-05128487

DEFINITIONS

China Technology Index - The NASDAQ OMX China Technology Index is designed to track the performance of technology companies that are domiciled in China or Hong Kong.

Cloud Computing Index – The ISE CTA Cloud Computing Index is designed to track the performance of companies actively involved in the cloud computing industry. The Index began on December 31, 2007 with a base value of 100.00.

NASDAQ Index: The NASDAQ is a modified capitalization-weighted index. The stocks' weights in the index are based on their market capitalizations, with certain rules capping the influence of the largest components. It is based on exchange, and it does not have any financial companies.

Social Media Index - The Solactive Social Media Index tracks the price movements in shares of companies which are active in the social media industry, including companies that provide social networking, file sharing, and other web-based media applications. ... The index is calculated as a total return index in USD.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. This memorandum is being made available for educational purposes only and should not be used for any other purpose.

The information contained herein does not constitute and should not be construed as representation or solicitation for the purchase or sale of any security or related financial instruments in any jurisdiction. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing.

Investing involves risks including possible loss of principal. Past performance does not guarantee future results. Any investment or investment strategy outlined herein are not suitable for all investors, readers should conduct their own review and exercise judgment prior to investing. Wherever there is the potential for profit there is also the possibility of loss. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors.

This report expresses the opinions and views of the author as of the date indicated and are based on the author's interpretation of the concepts therein, and may be subject to change without notice. Neither Highcroft, Inc., Gerald Asplund, nor LPL Financial, has no duty or obligation to update the information contained herein.

To the extent you are receiving investment advice from a separately registered independent investment advisor or broker, please note that Highcroft, Inc., Gerald Asplund, and LPL Financial are not an affiliate of and makes no representation with respect to such entity.

Certain information contained herein concerning economic trends, Fundamentals, and/or Technical analysis, and performance is based on or derived from information provided by independent third-party sources. The economic forecasts set forth in this material may not develop as predicted.

Technical analysis is generally based on the study of price movement, volume, sentiment, and trading flows in an attempt to identify and project price trends. Technical analysis does not consider the fundamentals of the underlying corporate issuer.

The sources from which information has been obtained is assumed to be reliable; the accuracy of such information is not guaranteed and the accuracy and completeness of such information has not been independently verified.

From time to time the publisher, his associates or members of his family may have a position in the securities mentioned in this report: This report, including the information contained herein, has been prepared exclusively for the use of Highcroft, Inc. clients, and may not be copied, reproduced, redistributed, republished, or posted in whole or in part, in any form without the prior written consent of Highcroft, Inc.

All indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. All performance referenced is historical and is no guarantee of future results. Investing in the index would require investors purchase an investment product, which would involve fees and expenses.

The fast price swings in commodities and currencies can result in significant volatility within an investor's holdings.

ABOUT US

Highcroft Investment Advisors provides retirement planning, investment management, financial planning, fiduciary investment management, and lifetime income planning. Certified Financial Planner. Working with business owners, individuals, and wealthy families near Wayzata, Minnetonka, Plymouth, Orono, Minnetrista, and Minneapolis Minnesota (55402, 55391, 55447, 55364, 55428).

Highcroft Investment Advisors serves as a 3(21) and 3(38) Investment Advisor and fiduciary for labor union supplemental 401(k) and pension plans and corporate 401(k) plans. Highcroft works with the union's counsel, recordkeeper, administrator, and the plan's trustees. United Association, Plumbers, Pipefitters, Steamfitters, IBEW, and Carpenters. Serving Wisconsin and Minnesota. 401(k) investment management provided through LPL Financial's corporate RIA - offering 3(21) and 3(38) services.

Working with business owners, individuals, and wealthy families near Wayzata, Minnetonka, Plymouth, Orono, Minnetrista, and Minneapolis Minnesota (55402, 55391, 55447, 55364, 55428). As independent financial advisors we are not driven by certain products or services, instead we focus on your needs as an individual. Services include fiduciary fee only, retirement and divorce financial planning, life insurance, capital preservation, lifetime income planning, bonds, stocks, ETF, income, IRA, brokerage, rollover IRAs. Financial advisor near me, financial planner near me, independent planner near me.